In today’s business environment, companies need more than just “books that balance.” They need real-time visibility, scalable workflows, automation, and insight to support growth, compliance, and decision-making. NetSuite delivers a unified ledger, integrated modules (GL, AR, AP, fixed assets, etc.), and dashboards that move bookkeeping & accounting from “after-the-fact” to a forward-looking business asset.

For your bookkeeping/accounting firm (like Accounting Fresh CPA Inc.) that supports Construction, Service-based, and Health & Wellness businesses, NetSuite offers a platform that can scale, integrate multiple entities, streamline month-end, reduce manual effort—and free you and your team to focus on value-added CFO/consulting work rather than data entry.

Key Capabilities of NetSuite for Accounting & Bookkeeping

Here are some of the specific features and how you can leverage them:

- Unified General Ledger – All transactions (sales, purchases, payroll, fixed assets) feed into one ledger. This reduces the risk of disconnected systems or manual journal entries.

- Automated Bank & Credit-Card Feeds / Reconciliation – Modern bookkeeping expects near real-time matching of transactions. NetSuite supports automation of feeds and reconciliation, freeing up time for analysis.

- Customizable Chart of Accounts (COA) – The COA is the backbone of reporting and analysis. NetSuite allows you to design the COA (and dimensions) that align with the business’s structure.

- Workflow & Approval Automation – On the accounts-payable side (and elsewhere) you can setup approval paths, notifications, multi-level review, vendor-management all within NetSuite.

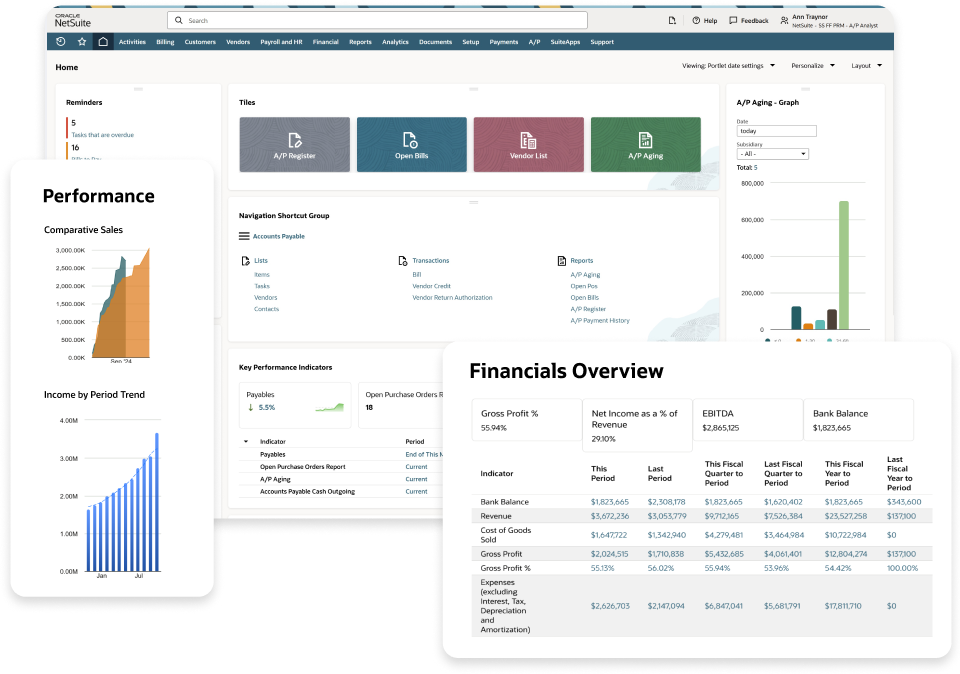

- Real-Time Dashboards & Reporting – Instead of waiting for month-end, stakeholders can see key metrics (cash-flow, DSO, DPO, departmental costs) instantly, spot issues, and act.

- Scalability & Integration – As your client grows (or you support multiple entities/subsidiaries), NetSuite handles multi-entity, multi-currency, more complex workflows.

Best Practices for Using NetSuite Effectively

To really maximize NetSuite (and avoid it becoming just “expensive software”), here are recommended practices:

1. Start with a Clean, Thoughtful Setup

- Design your Chart of Accounts (COA) with future reporting in mind: think by business-unit, service line, job or project if needed. A poorly-designed COA leads to cleanup work later.

- Define dimensions/segments in NetSuite (e.g., location, department, project) so you can slice and dice results without proliferating thousands of GL accounts.

- Set up user-roles & permissions from the start to enforce internal controls (who can post journals, approve bills, view sensitive data).

- Decide on automation rules early: bank feeds, rules for recurring journal entries, AR/credit-card transaction matching.

2. Automate the Routine, Free up Time for Insight

- Link bank/credit card accounts so transactions flow in automatically rather than manual entry.

- Set rules to auto-categorize recurring transactions when possible (e.g., certain vendors always go to specific expense accounts).

- Use approval workflows for bills/invoices: e.g., if purchase > $X then two approvals; mobile notifications.

- Automate AR follow-up: aging reports, reminders, automatic application of cash.

- Use dashboards to monitor key metrics and exceptions rather than chasing every transaction.

3. Maintain Data Quality & Clean Up Regularly

- Periodically review master-data: vendors, customers, GL accounts, inactive accounts—remove duplicates, ensure active ones are correct.

- Run monthly reconciliations and journal reviews so the books stay audit-ready rather than “scrub at year-end.”

- Archive or retire old accounts/processes when business changes: e.g., service line removed, location closed.

4. Streamline Month-End / Close Process

- Use NetSuite’s closing features (lock periods, ensure all journals posted) to tighten close.

- Prepare recurring journal entries in advance (e.g., amortization, accruals) so they’re ready when period ends.

- Set up customized financial statements (P&L, Balance Sheet, Cash Flow) with dimensions. Provide to stakeholders quickly.

- Leverage NetSuite to generate reports automatically and distribute (e-mail, CSV, dashboard).

5. Use Reporting & Insights for Strategic Conversations

- Beyond “books done,” use NetSuite data to advise clients: e.g., “Your DPO is creeping up — we should evaluate vendor terms,” “Project X’s margin is trending lower than budget,” etc.

- Establish KPIs aligned to your clients: for example, for your service-based clients you could monitor job-cost % of revenue, hours per project, cost per service line, backlog to billings ratio. Then build the dashboards in NetSuite.

- Make sure stakeholders (owners, managers) have access to self-serve dashboards of key metrics rather than depending solely on month-end package.

6. Stay Current & Evolve

- NetSuite releases updates. Ensure your team (and your clients) stay trained on new features or modules that might benefit them.

- As the business grows or changes (add a subsidiary, new service line, international operation) revisit processes, COA, dimensions, automation. Don’t let the system become legacy or “just stuck.”

- Review and refine workflows: what used to work when 10 employees may need changes at 50+; roles, approvals, vendor volume, payment run logic may need adjustment.

How This Applies to Your Clients (Construction / Service-based / Health & Wellness)

Since your firm focuses on these industries, here are some tailored thoughts:

- Construction: Projects often mean job costing, change orders, retainage, progress billing. Use NetSuite’s dimensions for “job” or “project” to track direct costs and indirect overhead. Build dashboards showing cost-to-complete, margin by job, backlog.

- Service-based: Time & material vs fixed-fee engagements require tracking hours, expenses, cost of service delivery. Leverage NetSuite for work-in-progress, deferred revenue (if applicable), and profitability per service line.

- Health & Wellness: Whether it’s multiple locations, membership models, recurring revenue: you’ll want dashboards around client count, retention, cost per client, and compare to expense structure. NetSuite can integrate multi-location data.

In each case, your role as the outsourced CFO/bookkeeping advisor means you can implement NetSuite best practices for clients (setup, dashboards, process design) and then provide ongoing insights (rather than just “closing the books”).

A Checklist for Onboarding / Optimizing NetSuite

You may want to include a checklist for clients or internal use. For example:

- Define reporting requirements & KPIs.

- Design Chart of Accounts + dimensions (job/project, location, department) aligned with KPIs.

- Configure user-roles and approvals (AP, AR, journals).

- Link bank/credit card feeds; setup auto-categorization rules.

- Establish AR & AP workflow rules (invoices scanning/OCR, approval workflow).

- Build dashboards for key metrics (cash-flow, DSO, DPO, margin by project/service line).

- Define monthly close process: timeline, responsibilities, recurring journals.

- Conduct data clean-up: duplicate vendors/customers/GL accounts, inactive accounts removed.

- Train users (finance team + business managers).

- Schedule periodic review: quarterly system/process audit to ensure NetSuite evolves with business.

Final Thoughts

Platform alone doesn’t equal value. The real differentiation comes from aligning strong accounting/bookkeeping discipline with the capabilities of a powerful system like NetSuite—and then translating that into actionable insight for the business. For your firm, the opportunity lies in being the guide: helping clients not only “use NetSuite” but “leverage NetSuite to drive margin, growth, and peace of mind.”